What Makes Good Money in the Information Age?

The legendary Harvard business professor Clayton Christensen pioneered two incredibly important discussions:

In the innovator's dilemma there is sustainable innovation and disruptive innovation.

Sustainable innovations are evolutionary improvements but do not fundamentally alter the demand for products. They consist of reducing defects, making something faster or more powerful.

Disruptive innovations appear to be doing everything wrong. They often have lower performance in key features valued by the market, more defects and less speed or power. Eventually disruptive innovations fundamentally alter the marketplace and overturn incumbents.

The difference is that sustainable innovations are about meeting current market needs whereas disruptive innovations are about meeting future market needs. Disruptive innovations are often born in niche markets and target needs that are often neglected by current market offerings. The small niche markets may not care as much about traditional performance features.

Additionally, these small niche markets are good for startups because as long as their innovation has the potential to improve performance rapidly then the small initial market gives them more time to fine-tune their technology and they do not need to worry too much about their larger competitors who usually just ignore them.

In "Understanding the Job," Professor Christensen uses the case study of 'Why Hire the Milkshake?' In this example, he discusses why people 'hire' certain 'goods' to perform particular 'jobs'. And the subjective value people get from different goods may not always be as intuitive as you think.

Often people and economists will discuss the quantity of money but rarely will they discuss the quality of money and how that relates to demand for money. The higher the quality of a good in each of those ten characteristics then the greater the demand for it.

The quality of money is a subjective concept and should stand at the center of a monetary theory based on human action. Money serves people in attaining their subjective ends more efficiently and it fulfills certain functions for people. The better these functions of money are fulfilled in the eyes of actors the higher they value money. The quality of money is, consequently, defined as the capacity of money, as perceived by actors, to fulfill its main functions, namely to serve as a medium of exchange, as a store of wealth, and as an accounting unit.

Good money in the Information Age is (1) recognizable, (2) scarce, (3) censorship resistant, (4) durable & indestructible, (5) extensible, (6) salable, (7) portable, (8) fungible, (9) private and (10) divisible.

The mission of the MWC developer team is to match and exceed every other good in the market with regard to these ten monetary characteristics in order to produce a good that is the superior qualitative money.

As stated in the Roadmap, there are many potential places development resources can be allocated and they will be chosen based on market needs with highest priority given to requests that will primarily benefit and come from the buyers and hodlers of last resort. That means sellers of first resort, miners, etc. are not very high on the priority list.

In this article, we will compare and contrast gold, fiat currencies, Bitcoin and MWC. After all, what job are you hiring each of these to perform?

Day by day and year by year Bitcoin has earned user’s trust by, as discussed by Stephen Livera and Chris Belcher, performing well the job of loudly storing and indiscreetly announcing the transferring of value. MWC is the most technologically superior ghost money on the market that performs the job of silently storing and stealthily transferring value. Objectively, this is a more difficult job to do than what Bitcoin has done.

The Critical Question

The critical question the MWC product is addressing, that has not been decided in the market because no product currently exists to adequately serve that possible market demand, is:

Whether sound money, as valued by the market, considers fungibility an important factor?

Recognizable

A good money must be recognizable and the easier to recognize the better. The cost to properly recognize money is extremely important in that particular good’s ability to compete.

For example, gold has a specific definition and is defined on the periodic table. Nevertheless, in order to safely and securely recognize gold it requires a refinery to melt it down. This is very expensive. In other words, the cost to run a gold full-node is very expensive.

On the other hand, the USD, EUR, YEN, GBP and other fiat currencies are widely used as currency in transactions around the world. In large amounts, it requires a bank account to be safely and securely storing and recognizing one’s cash. Many shops will not accept anything larger than a $20 bill. North Korea has been notorious for counterfeiting $100 bills. Cash machines, that count and verify the authenticity of bills, can cost hundreds of dollars.

Crypto-currency is usually much easier and cheaper to recognize. You simply download a full-node and run it. Enforcement of the consensus rules make it easy to recognize whether a Bitcoin is a Bitcoin or whether a MWC is a MWC.

It is important for the cost to run a full-node be cheap. In Bitcoin’s case, an old laptop will do the trick. In MWC’s case, the requirements are even lower because of how the scalability improvements with Mimblewimble work. The Initial Block Download (IBD) is much faster with MWC than BTC. Both are significantly cheaper than running a USD or gold full-node.

Scarce

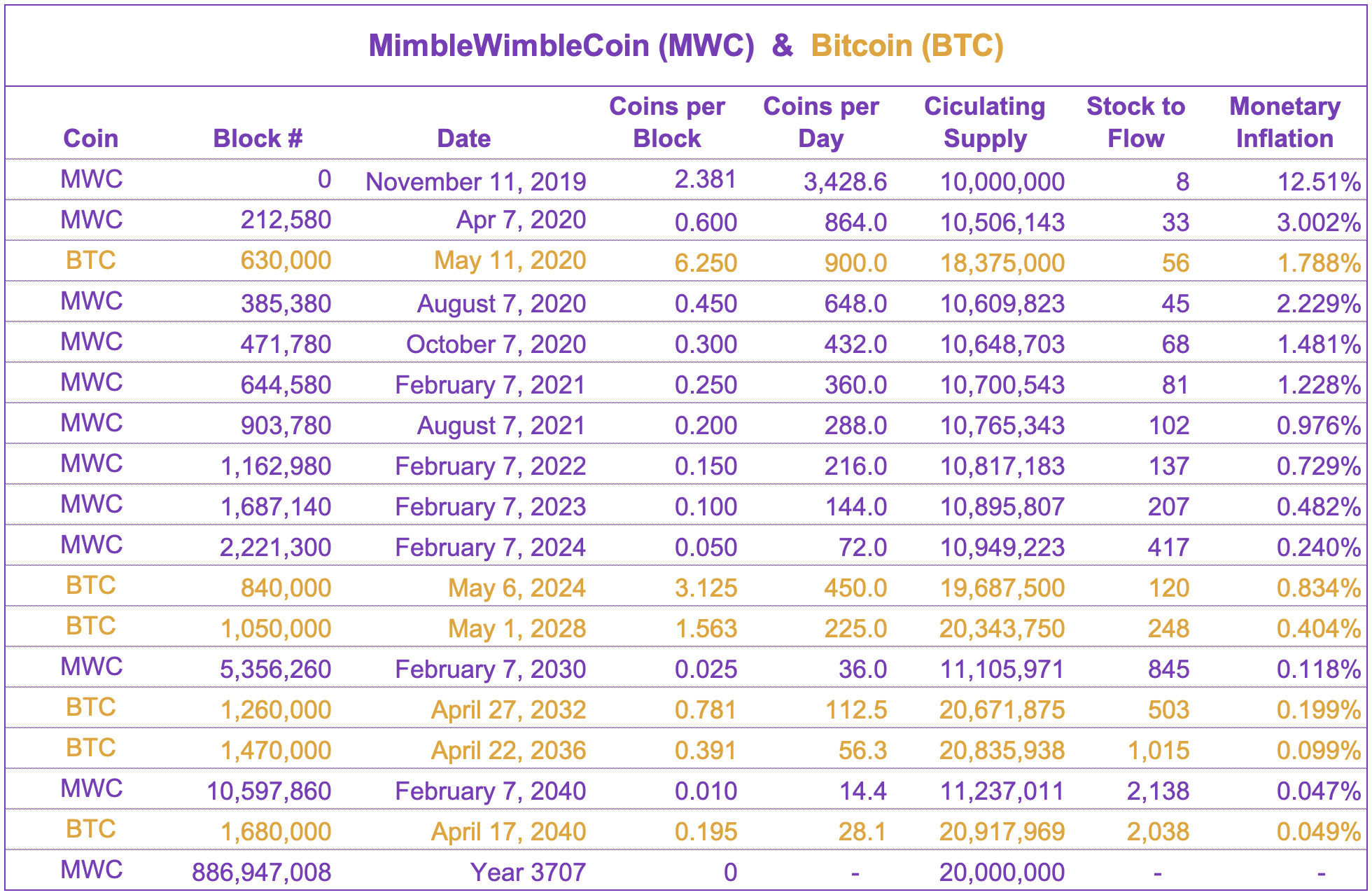

A good money must be scarce and the primary measure of scarcity is the stock-to-flow ratio. This ratio divides the current stock by the annual flow. When an asset begins to gain monetary premium then producers will want to increase the supply and capture the profit from doing so. As Saifedean Ammous has explained in "The Bitcoin Standard", the harder it is to produce more relative to the current stocks the better and cheaper the good protects value for the holders.

The difference between the cost to produce the good and market value is a profit for the producer and is an expense to the current holders. Everything else being equal, the higher the stock-to-flow ratio then the lower the expenses for a hodler to use that asset as a store of value.

And the trade-off appears to be, and pure proof of work is the most secure mechanism discovered so far, emission rate for security because the higher the emission rate the greater the subsidy from holders to miners to provide greater hashrate which results in higher cumulative difficulty.

Gold has been the asset with the highest stock-to-flow asset in the world for millennia. According to gold.org, the total above ground stocks of gold are about 136,000 tons and there are about 2,000-3,000 tons produced annually. Thus, the stock-to-flow ratio is between 45-68 or 136,000 divided by 2,000 to 3,000.

Gold has stood the test of time of being difficult to produce more of it. This is why it is the ancient metal of kings. It protects property rights by preventing confiscation through inflation.

The USD, EUR, YEN, etc. are fiat currencies. Their supplies are determined behind closed doors by financial and political elites. Their source code is private. You cannot run a full-node. And the emission rate is unknown. Nevertheless, billions of people use fiat currencies daily.

Yet the fiat currency graveyard is littered with thousands of paper franchises that have become worthless. Consequently, we do not have a secure way to know what the stock-to-flow ratios are for these type of altcoins.

Although MWC is a pure proof of work coin the initial stock had to be created somehow. Options included mining, a fork, an airdrop or some other method. Because MWC is a product built by Bitcoin holders and for Bitcoin holders, therefore, a method was decided upon that would maximize value for both buyers and hodlers of MWC and any Bitcoin holders who willfully chose to participate.

As discussed in the first version of the whitepaper in January 31, 2019, 10,000,000 MWC would be proof of work mined and 10,000,000 MWC would be created in the genesis block. 2,000,000 MWC were immediately distributed to the developer team, 2,000,000 MWC were allocated to the HODL Program and 6,000,000 MWC were allocated to be airdropped to any Bitcoin holders who successfully registered and claimed. On October 26 2020, the Dev fund, the HODL Program and the unclaimed airdrop was completely distributed to MWC hodlers.

Using a different method, like purely mining, would have resulted in a highly inflationary product that would be extremely detrimental to the financial interest of buyers and hodlers and, therefore, be inferior money because it would lack characteristics of good money.

Good money in the Information Age is (1) recognizable, (2) scarce, (3) censorship resistant, (4) durable & indestructible, (5) extensible, (6) salable, (7) portable, (8) fungible, (9) private and (10) divisible.

Just look at fiat currencies, many forks like Bitcoin Cash or XRP and it is apparent that the market does not appear to value the method for the creation of the initial stock of a monetary good or product but only whether its current characteristics provide usefulness as good money.

Just because a large supply of MWC was created in the genesis block on November 11, 2019 does not mean that it had any value in the market. A market formed and willing buyers and sellers began trading. In fact, shortly after the first airdrop funds were distributed MWC hit an all-time low of $0.25 on December 3, 2019 with a market capitalization less than $2m.

That is how price discovery started to happen for MWC.

The difficulty adjustment algorithm is the mechanism to determine the emission rate in crypto-currencies. In Bitcoin’s case, this happens every 10 minutes and adjusts every approximate two weeks. Every four years is a halving and after the May 2020 halving then the Bitcoin stock-to-flow ratio will be approximately 56. This will make it comparable to gold.

Like Bitcoin, MWC uses a pure proof of work algorithm and has the highest stock-to-flow ratio of any base layer Mimblewimble coin. By October 2020 MWC, will have a stock-to-flow ratio almost equal to Bitcoin's and by February 2021 it will have a significantly higher stock-to-flow ratio.

We recommend you review the consensus rules to get a better understanding of the exact rapidly hardening emission rate. The MWC Team considers the protocol ossified and currently sees no need for a future hard or soft fork unless a defensive action were required to protect the network.

Censorship Resistant

A good money must be censorship resistant. Political currency, like the USD, EUR, GBP, YEN, etc., have been and will be wielded against political opponents. Even gold, which is much more susceptible to censorship than crypto-currency, has been under siege through legal tender laws, taxation, confiscation and a myriad of other nefarious schemes.

Bitcoin has shown the world the power of what a censorship resistant distributed decentralized peer-to-peer network can do. This Internet Protocol has enabled billions of transactions in its short decade long life.

Governments, no doubt, would want to shut it down if they could. But like Bittorrent and the Internet doing so would be extremely difficult. There are even satellites that beam the blockchain down over the entire globe for free.

And data wants to be free so it is very difficult to impede its flow. Bitcoin enables value transfer over a communications channel so that makes it much more difficult to impede.

But there are chokepoints that governments such as taxation, exchanges, money transmission laws, custodianship laws, property rights, freedom of speech and a myriad of other tools. With the delicate balance of economic incentives and the security of pure proof of work crypto-currencies like Bitcoin or MWC there are many things governments can do to erode their censorship resistance. But the stronger the fundamental monetary properties of the network then the less susceptible the network and actors that use or secure the network will be.

Additionally, no one has forced either Bitcoin or MWC as a medium of exchange. Their value has been won through the free will and peaceful cooperation of individual actors in the market. Unlike fiat currencies which have part of their value as an instrument of law and force. Everyone has access to all of the source code all of the time. There is not deception, obfuscation, fraud or violence which underpins the value of Bitcoin or MWC. Because they are freely chosen therefore they are more censorship resistant.

Consequently, because Bitcoin is older and more entrenched it is more censorship resistant. MWC may get there some day if there are more full-nodes, more community members, holders and users.

Durable & Indestructible

A good money must be durable. Your local mouse can chew through a bunch of USD, EUR, YEN, etc. all day long. But if fiat currencies are held in a bank account then they are pretty durable so long as the bank is not in danger of failing or the financial system is not imploding like during 2007-2008.

Created in supernovas, gold can sit at the bottom of the ocean for millennia and not be eroded or dissipated. Outside of some crazy movie plot like in Goldfinger there is pretty much nothing that can be done to destroy gold. Gold’s durability is extremely entrenched.

Likewise, the Bitcoin source code and ledger exists on hundreds of thousands of computers all over the planet. This adds a level of durability that has not been seen heretofore. However, few full-nodes are run completely through TOR or other networks that offer complete privacy of location. This means that significant amounts of metadata can be associated with full-nodes from ISPs, listening nodes on the network, etc. and the operators of those full-nodes could be targeted. This could result in less durability and greater destructibility of the network.

MWC is also merely data like Bitcoin. This makes it extremely easy to copy and distribute around the globe. While MWC is still in its infancy the decentralized distributed network is not nearly as robust as Bitcoin’s. But every holder and user has a financial incentive to run their own full-node and make MWC more durable.

MWC has significantly greater scalability characteristics than Bitcoin and legacy blockchain technologies. This makes possible and practical certain user behaviors that would not be as practical with other less scalable blockchains. For example, in QT wallet 1.0.22 the ability for TOR transactions by default with no user setup was introduced. MWC-node 3.2.3 introduced the ability for TOR outbound connectivity which provides complete privacy of location and, consequently, greater durability of the MWC network.

The MWC network will become significantly more indestructible when TOR inbound connectivity is enabled and the mobile wallet is released. Then all MWC full-nodes will be indistinguishable and operating both inbound and outbound connectivity while being cloaked behind TOR and, possibly, from anywhere.

Additionally, because MWC is so scarce and caters to the holders of last resort there seems to be a much smaller UTXO set. This results in greater scalability, less resource usage, a more resilient blockchain and greater indestructibility.

Extensible

In the Information Age a good money must be extensible. Extensibility is a software engineering and systems design principle that provides for future growth, is a measure of the ability to extend a system and the level of effort required to implement the extension. Extensions can be through the addition of new functionality or through modification of existing functionality. The principle provides for enhancements without impairing existing system functions.

Gold is just an atom and has no extensibility. Therefore, it is very easily outcompeted by those goods which can be modified and improved.

Fiat currencies are extensible with all kinds of advancements possible. There are entire industries and companies dedicated to doing this like Paypal, Venmo, Transferwise, Moneygram, Goldman Sachs and the Federal Reserve. They are all seeking to make the fiat currencies more useful and helpful for consumers to increase demand. Governments often introduce legislation or regulation which greatly hinders the usefulness the good can provide or even actively decrease the monetary properties.

Bitcoin is just software and therefore extensible and there are a multitude of advancements and improvements that have been and will be introduced. Multi-signature, Lightning Network, Schnorr signatures, Taproot, Coin Shuffle, eltoo, musig, CoinJoin, Dandelion, Confidential Transactions, Coin Swap, MAST, Simplicity, Hivemind, Neutrino, BTCPay, atomic swaps, Elements, Liquid, FIBRE, Stratum V2, channel factories and so much more.

The advancements and potential of Bitcoin are almost limitless. However, there are valuable extensions which are either not likely or impossible to get implemented into Bitcoin. For better or worse, Bitcoin has and continues to rapidly ossify.

For example, it is highly unlikely or a very long ways away, or perhaps impossible because of regulatory pressure and various stakeholders, to have provable security for private and fungible transactions, to introduce a soft-fork to reduce the block reward at a faster rate thus increasing the scarcity and stock-to-flow ratio or implementing Mimblewimble in the base layer to have greater scalability, provable scarcity and complete privacy and fungibility.

MWC is also just software. Because Mimblewimble is native in the base layer it already has all of the tremendous advantages and upgrades that come from that superior blockchain technology. However, it may not be able to be as flexible with scripts or other features that Bitcoin might have. This is one reason why Bitcoin and MWC can be extremely complementary with each other.

Saleability

A good money must be salable. Menger defines saleability as a "facility with which [a good] can be disposed of at a market at any convenient time at current purchasing prices, or with less or more diminution of the same."

In other words, when moving a good the larger the volumes with lower spreads, in other words less slippage, then the more saleable the good is. Mises talks about how a good's high marketability draws more demand, which increases their marketability, which draws forth still more demand, and so on. This continues until a few goods are selected as "common media of exchange."

Therefore, people will want good money and attach a monetary premium for its liquidity.

The fiat currencies have tremendous network effects and saleability. Trillions of dollars worth of fiat currencies are traded every day in the foreign exchange markets. The US Dollar is the world reserve currency. Trillions of dollars of value can be moved with very little 'slippage'. Gold is also tremendously liquid with tens of billions of dollars of daily volume.

In ten short years, Bitcoin has become a behemoth of liquidity with tens of billions of dollars of daily liquidity, hundreds of exchanges, options traded among the largest Wall Street players and millions of users.

MWC mainnet launched in November 2019. The speculation network effect that attracts traders is still in its infancy but growing. As the knowledge of MWC and its superior monetary properties spreads then there will be increased demand for MWC and greater entrepreneurial opportunity for traders and other liquidity providers.

Overtime, MWC's liquidity may be similar to Bitcoin, gold or even some of the major fiat currencies. It will all depend on how much demand there is from the market for a good with these type of monetary properties.

Portable

A good money must be portable. In the Information Age, this means being able to transfer value over a communications channel.

Gold is analog. There is no way to send it over a fiber optic cable halfway around the world. This means to transfer value with it one is required to use additional layers or services.

Fiat currencies are notoriously difficult to move around because of governmental regulations with money service business laws, money transmitter laws, banking licenses, etc. that all vary by jurisdiction. Storing and moving value around is the most regulated industry in the world. As a result, there has been very little innovation and obsolete methods are primarily used because of institutional inertia. This is an area of the economy ripe for disruption.

Bitcoin has shown the world how easy it is to store value in a purely digital method and send it to anyone, anywhere and at anytime. The monetary sovereignty that comes from running one’s own full-node and holding one’s own private keys is incredibly liberating. There is no need to use snail money anymore.

Additionally, because of Bitcoin’s huge liquidity pipelines it is easy to move back and forth with the legacy system. This makes it very portable to move value between different areas of the economy.

MWC has all the advantages that Bitcoin does from being purely digital. However, there are not nearly as many liquidity pipelines for MWC. It needs to be accepted on more exchanges, have more brand recognition, be more used, have more trading volume, etc. And MWC/BTC atomic swaps greatly increase MWC’s seamless movement of value between MWC/BTC and the greater economy.

Fungible

A good money must be fungible. Fungibility means the goods are mutually interchangeable or able to be replaced by another identical good.

Gold is a great example because an atom of gold is identical to another atom and this fungibility is in the base layer of the gold. There may be differences added at higher layers like with serial numbers, gold certificates, warehouse receipts, AML/KYC, etc. that gold dealers are required to add. But at the base layer the gold could always be melted down and recast destroying any previous transaction history or other abstractions.

Fiat currencies are less fungible. They all usually have serial numbers or if they are held in bank accounts then there is personal identifying information attached to the bank account. All of this impinges on the fungibility of the fiat currencies. Nevertheless, governments often have laws, like legal tender, etc. that gives preferences to fiat currencies so that they can circulate unimpeded in the economy.

Bitcoin, a legacy blockchain, is an immutable record of the intimate financial details of every transaction. This means that the UTXOs have a permanent history that impedes their fungibility. There is no way to destroy this permanent history.

Which begs the obvious question: How can Bitcoin function as digital gold when it lacks this fungibility characteristic?

Blockstream Chief Strategy Officer Samson Mow said, "Money needs to be private and fungible in order for it to be a 'good' money. With Bitcoin, every transaction is open for anyone to see, so we still have a lot of work to do to get it there. Without privacy and fungibility, money can be used as a tool for oppression or financial surveillance. Bitcoin is the future of money and the future of money shouldn’t be Orwellian."

Many Bitcoin users consider this lack of fungibility a feature and not a bug. It enables greater integration with the regulatory climate. And many powerful and entrenched Bitcoin stakeholders have strong financial incentives to play within the regulatory climate like exchanges, tax collectors, miners, regulators, law firms, etc.

But that lack of fungibility comes at the cost of it being increasingly more difficult to have plausible deniability of Bitcoin ownership.

In some jurisdictions, like Argentina which has a 2.25% annual wealth tax, if they can see it then they will take it or they will take you. Consequently, lack of fungibility and privacy may make Bitcoin a less desirable product for those users.

And while it may be useful for some circumstances like smart contracts it does have drawbacks in the monetary properties because it makes bitcoins less fungible. And many other blockchains, like Litecoin, Dogecoin, DASH, etc., also share these same limitations.

Another problem is that using homomorphic encryption is generally considered risky because there is no mathematical proof or other secure way to prove that hidden inflation has not happened. This puts at risk the scarcity property. For example, ZCash had a hidden inflation bug and it could operate undetected.

Mimblewimble is an extremely powerful blockchain upgrade that yields tremendous improvements in scalability, privacy and fungibility. By utilizing the Excess Value every transaction is CoinJoined with Confidential Transactions in the base layer.

This means that on the public blockchain there is no information about the details of the transactions but, based on the 2018 paper titled "Aggregate Cash System: A Cryptographic Investigation of Mimblewimble," by Fuchsbauer and et. al., the scarcity of MWC is not in jeopardy because by using Mimblewimble technology the “assets are provably secure against inflation and coin theft under standard assumptions."

Private

A good money must be private. Leaking intimate financial details provides knowledge to business competitors, corporations, insurance companies and governments. They can use this knowledge against you in pricing or other practices.

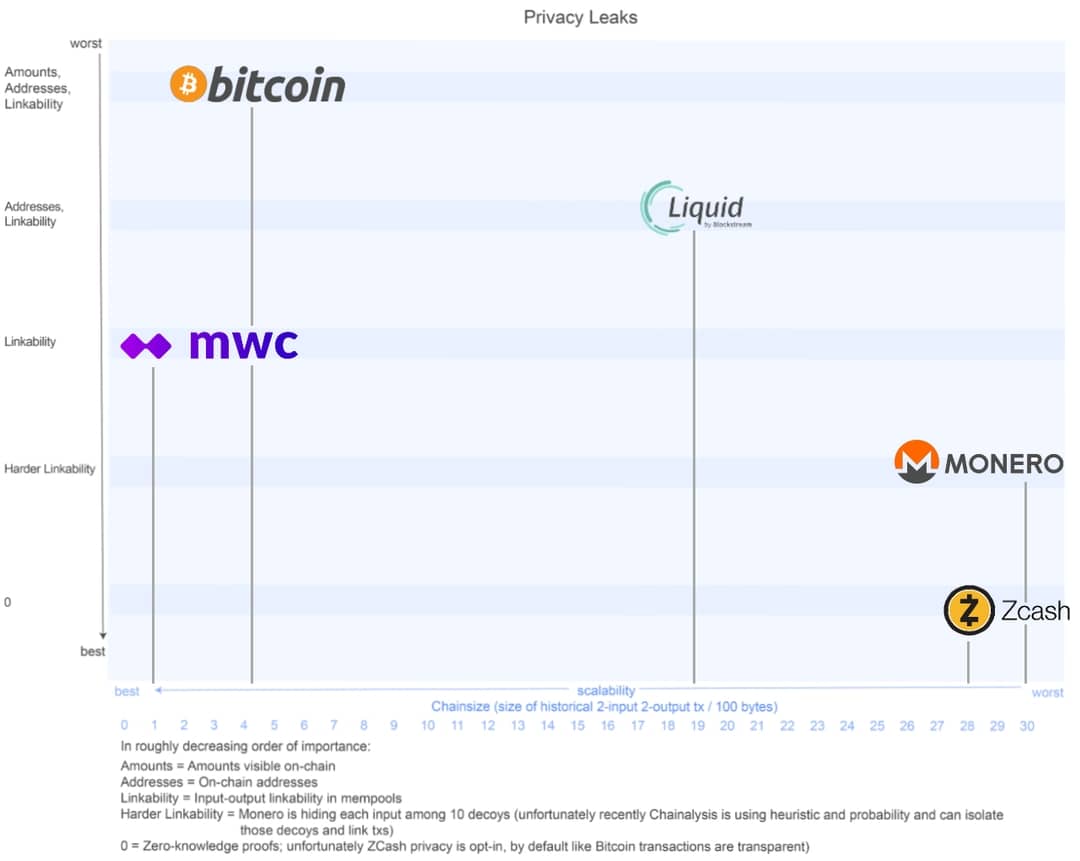

There are three main aspects of privacy in a cryptocurrency.

- Privacy of amount

- Privacy of location

- Link-ability

Gold is not used for very many ordinary daily transactions so it is not really an option.

Cash can be used by people to buy their tacos and prevent their insurance companies from buying their credit card transaction history and increasing their premiums. But what about for larger transactions like a house or a boat?

But how does one engage in private online transactions? Perhaps it is buying something that the person does not want everyone else know they bought like Hillary Clinton’s latest book. Or perhaps they want to donate to a political cause but do not want to be targeted by the IRS targeting controversy or something like Operation Chokepoint or the Wikileaks Banking Blockade.

These are all risks that have come as a result of political currency being increasingly politicized. And using a politicized currency introduces unnecessary political risks to value stored and to your business or lifestyle built on top of such a risky foundation.

Many countries implement a wealth tax which is a tax on an entity's or individual's holdings of assets. The rates that apply on an annual basis to the value of wealth vary by country but some examples are Argentina's Impuesto a los Bienes Personales in 2019 with 0.75%, Canada with 0.4%, France with 1.5%, Spain's Patrimonio with 3.75%, the Netherlands with 1.2%, Norway with 0.85%, Switzerland with cantonal rates ranging to 0.94% and Italy's IVIE of 0.76% and IVAFE of 0.20%.

With countries engaging in massive amounts of monetization and extreme money printing there are some who foresee large amounts of price inflation. This will act as confiscation through inflation which is a form of taxation without representation or due process of law. Some argue that one way to protect oneself from this predation is to have assets that can be neither printed nor seen. However, the MWC Team's position is that taxes should be viewed as voluntary and even if one has the ability to protect oneself with an asset that can be neither printed nor seen, nevertheless, one should still pay whatever taxes are legally owed.

Although Bitcoin cannot be printed, unfortunately, Bitcoin can be seen. Therefore, holders of Bitcoin are not immune to this kind of predation because Bitcoin has an open and transparent ledger. Major Bitcoin merchant processors refuse to process payments for gambling, porn, marijuana and a host of otherwise legal activities that carry social stigma and because of government regulator intervention. But government regulators are comfortable with Bitcoin and there are large liquidity pools with regulated exchanges, etc.

Like Bitcoin, MWC cannot be printed. However, all transactions in MWC are private and fungible in the base layer and the scarcity of the coins is still preserved because of how the Excess Value works. This means there are neither block explorers for snoopy people to look for large balances nor ‘whale alerts’ when people are moving their MWC around. There are no ‘tainted’ coins. There is just MWC and all are equal, fungible and private.

Currently, MWC users have largely complete privacy of amount because of Confidential Transactions and privacy of location since QT wallet 1.0.22 which enabled TOR support for payment methods and MWC-node 3.2.3, released July 4, 2020, which enabled TOR outbound connectivity capabilities.

Thus, it could be argued that Bitcoin's killer app is traceable sound money and MWC's killer app is untraceable sound money. With atomic swaps Bitcoin and MWC will tremendously complement each other in many use cases. By analogy, Bitcoin can act like a wealth VPN.

Transaction Example

The following Transaction Proof is for a 250,000 MWC transaction. A user can Generate Proof in the GUI wallet. Then the .proof file can be uploaded to the MWC Block Explorer to verify it was included in the blockchain.

The blockchain only contains data relics from the transaction which do not reveal anything about the sender, receiver or amount. Go ahead and check the output (09aee99c61d086d971cbc1da768d5511a0fe6e0a7f6b5d895bd1f1442550852d2f) or kernel (092a69fe56e95c62cd7f5eade2c5f91cf25bdb7ebd93bba82886f8807370b27c13) on the blockchain for yourself. And with the mathematical proof from Fuchsbauer the good is still 'provably secure against inflation and coin theft under standard assumptions.'

This makes MWC a much more private and fungible good. After-all, why leak transaction data to the public on an immutable legacy blockchain if you do not have to? Even Satoshi Nakamoto discussed this poor design feature in Section 10 of the Bitcoin whitepaper. His suggestion was to 'keep public keys anonymous'. But we have seen how that has worked with exchanges and AML/KYC laws. Unfortunately, Mimblewimble was not published to the public until 2016.

Divisible

A good money must be divisible. From the smallest micro-transactions to real estate payments the need for divisible is essential for price discovery by market participants.

While the Mona Lisa may be extremely rare it is not very divisible.

However, gold can be melted down and recast into a variety of standard denominations making for easy comparability. The Swiss have a saying, “Gold has no smell.” What they mean is when the gold is divided the transaction history is destroyed. This significantly helps prevent others from being able to track and trace it.

Fiat currencies have this, to some degree, with the physical bills although they are still uniquely identified with serial numbers. And when amounts are withdrawn from ATMs you can bet that the banks are keeping track of which serial numbers are associated with each other. And while bank accounts can easily divide the fiat currencies they still retain the transaction history with associated AML, KYC and other data.

Bitcoin and MWC are both purely digital. This enables them to be divided to the 8th and 9th digit respectively.

However, Bitcoin has an inferiority to MWC because the unspent outputs of Bitcoin are all unique. With MWC they are all shielded via Confidential Transactions and Coin Join. This means that when Bitcoin is divided then the smaller units are not exactly comparable because each has a unique history.